Sovereign Wealth as Statecraft

The Geo-economic Power of Sovereign Wealth Funds in a Multipolar World

Strategic Capital in a Fragmented World

The post-Cold War promise of liberal economic order has given way to a more contested terrain—one where capital is no longer neutral. In this new era of geo-economics, states are retooling their economic instruments to serve strategic ends. Industrial policy, investment screening, and supply chain realignment are no longer technocratic exercises; they are expressions of power. Sovereign Wealth Funds, once viewed as passive custodians of surplus, now play a significant role as holders of capital in this transformation in International Political Economy.

From Stabilization to Strategic Deployment

The origins of SWFs lie in fiscal prudence—vehicles designed to smooth commodity cycles and preserve wealth for future generations. As global capital markets liberalised and geopolitical competition intensified, their role evolved, capitalizing the now global financial markets. Today, SWFs manage over $13 trillion in assets, with leading funds in Norway, Abu Dhabi, and China shaping investment flows across sectors and continents. These funds are not merely financial actors; they are strategic instruments, calibrated to advance national interests in a multipolar world. Strategic Development Funds do not hold minority interests in listed firms; they act more like Private Equity funds with an investment thesis aligned with strategic national interests.

Sovereign Advantage: Deploying Capital with Intent

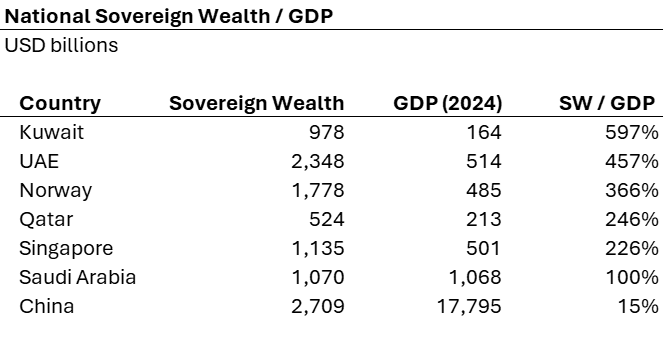

States with high Sovereign Wealth-to-GDP ratios possess a unique form of strategic agility. Freed from the constraints of electoral cycles and short-term fiscal pressures, they can deploy capital with patience and precision. In sectors like semiconductors, AI, and infrastructure, this long-horizon investment capacity offers a sovereign advantage—one that Western democracies, lacking institutional equivalents, struggle to match. Trump has called for the establishment of a national (federal) Sovereign Wealth Fund, but political fragmentation may render it aspirational.

Shaping Markets, Nudging Firms

Sovereign Wealth influences markets not through overt control, but through strategic alignment. With the rise of shareholder activism, the long term capital commitment and representation on boards allow these funds to steer corporate behaviour subtly but effectively. In doing so, they redefine value—not solely focused on financial return to shareholder, but strategic coherence. A subsidy, or in our terms, a political discount to their cost of equity, valued in terms of national strategic interest. This is geo-economic statecraft by other means, where capital becomes a lever for national positioning in critical industries.

The New Scrutiny: Capital Under the Microscope

As Sovereign Wealth becomes more visible in strategic sectors, they will face growing scrutiny. Investment screening regimes are tightening and protectionist sentiment is rising. Policymakers must now grapple with a new dimension of sovereignty: control over capital itself. While no state may achieve total capital hegemony, the ability to deploy sovereign wealth with geo-economic intent will remain a defining feature of global power in the decades ahead.