The Hard Budget Constraint: Why Sovereign Wealth May Struggle to Pivot East

Fiscal strain is forcing sovereign wealth to choose between domestic development and global geo-economic rebalancing

In the golden decade of sovereign wealth, Gulf states deployed capital with conviction — anchoring domestic industries, acquiring global assets, shaping, and being shaped by, geo-economics. As oil prices hover near $60 per barrel, the fiscal tide is ebbing. The soft budget constraint that once enabled bold strategic development is giving way to a hard budget reality. With this shift in tides, the ability of sovereign wealth funds to rebalance portfolios toward Asia — despite clear geopolitical logic — is increasingly constrained.

Petro-State Capitalism and the Rising Breakeven

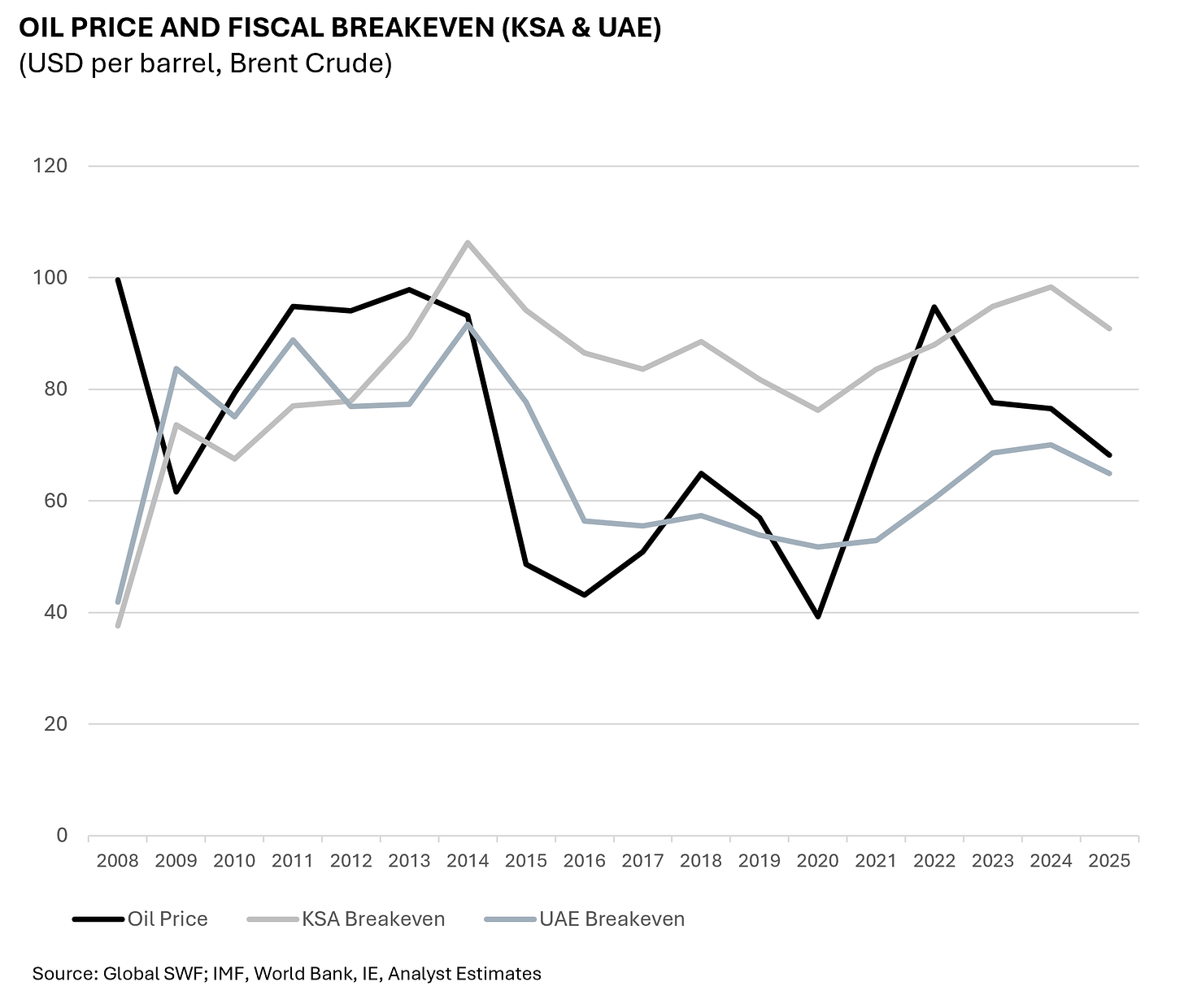

The Gulf’s model of petro-state capitalism — using sovereign capital to seed domestic sectors — is now facing its most difficult test. Projects like Neom in Saudi Arabia, Stargate in Abu Dhabi will require sustained, long-term capital (and energy) deployment. Yet the fiscal breakeven on oil, a key metric of spending capacity, is climbing. While this metric is estimated by global institutions, crucially, it excludes future capital commitments and replacement capex. The result: a misleading picture of fiscal flexibility.

As AI ambitions grow and real estate megaprojects scale, the breakeven rises — not just in theory, but in practice. Saudi Arabia and the UAE are now navigating a landscape where domestic obligations crowd out global optionality. The fiscal room to rebalance portfolios eastward is narrowing.

The Illusion of Optionality: Debt or Extraction

Faced with hard budget constraints, SWFs must choose: issue debt or extract value from existing portfolios. Both options are fraught. Debt issuance, while increasingly common, carries long term structural and macroeconomic risks — especially if AI fails to deliver promised returns. Portfolio extraction, meanwhile, is hampered by DPI challenges in private markets. Private market DPI ratios have fallen sharply — from an average of 23.6% pre-2020 to just 9.5% in 2024 — leaving SWFs with limited liquidity and few clean exit paths.

This tension is already playing out. In November 2025, Saudi Arabia’s Public Investment Fund (PIF) exited nine U.S. stocks, dragging its holdings to a multi-year low — a signal that fiscal pressure is already forcing capital discipline and portfolio contraction.

Geo-Economic Rebalancing Meets Fiscal Reality

The strategic case for pivoting east is compelling. Asia is now the Gulf’s largest trading partner and public markets are significantly underpriced compared to Western benchmarks. However, geo-economic rebalancing will require new capital, not just reallocation. And that capital is increasingly tied up in domestic mandates.

SWFs overweight in U.S. markets may struggle to diversify meaningfully without sacrificing domestic priorities. The hard budget constraint forces challenging deployment decisions, domestic development or global rebalancing. Something has to give.

The End of the Soft Budget Era

The fiscal breakeven is no longer just a number — it is a constraint. A constraint on ambition, on optionality and on geo-economic strategy. Gulf SWFs, especially those with dual mandates, must now navigate a world where capital is finite and trade-offs are real. Unless oil rallies or AI delivers outsized returns, the pivot east will remain more thesis than reality.

For asset allocators, the message is clear: expect more discipline, less deployment. For those watching the Gulf’s sovereign story unfold, this is the sequel to the soft budget era — one shaped not by ambition, but by arithmetic.